Business starter guides

/ General

How to Start a Cleaning Business in 7 Days (2025 Guide)

March 13, 2025

Last updated: October 10, 2025

33

min read

Christine Colling

Starting a cleaning business is one of the fastest paths to six-figure income. The global cleaning services market is worth over $424 billion and growing at 7.19% annually, according to Fortune Business Insights. The opportunity is huge.

But if you're like most aspiring entrepreneurs, you're stuck. Not because you lack ambition, but because every guide drowns you in a 12-step checklist before you make your first dollar. Write a business plan. Form an LLC. Build a website. Get business cards. Buy a van. By step three, you're paralyzed.

This guide is different. We'll show you how to get your first paying client in the next 7 days, then help you build the formal business around that proof of concept. No 30-page business plan required upfront. No months of preparation. Just action, validation, and growth.

Most guides follow the same intimidating path: Plan → Legal → Finance → Market → Hire. That's backwards - you end up with perfect paperwork but zero proof anyone will pay you. The real path is: Get paid → Prove it works → Formalize the structure. That's how 200+ successful founders did it, and that's what we'll show you here.

Day 1-2: Residential vs. commercial cleaning

Your first decision isn't what to name your business or which accounting software to buy. It's this: homes or offices?

Don't overthink it, but understand what you're choosing.

Residential cleaning means houses and apartments. Your clients are homeowners, renters, and property managers. You'll clean kitchens, bathrooms, bedrooms, and living spaces. This is where most beginners should start because you can get your first client within 24-48 hours through a simple Facebook post.

Commercial cleaning means offices, retail stores, warehouses, and medical facilities. The pay's higher – often 30-50% more than residential – but it takes longer to get hired. You're dealing with property managers and facility directors who make decisions slowly. Expect 60-90 days from first contact to first contract.

Here's how they compare:

Factor | Residential | Commercial |

How hard to start | Low - start immediately | Medium - requires quotes and bids |

How fast you can start | 24-48 hours possible | 60-90 days typical |

Income potential | $25-50/hour | $35-65/hour |

Scalability | High - hire per job | Very high - contracts worth $1K-10K/month |

According to IBISWorld, commercial cleaning accounts for about 55-60% of total industry revenue. It's lucrative. But residential is faster.

Here's advice from someone who's done it:

Start residential. You can get your first client from a Facebook post TODAY. Commercial takes months of relationship-building and RFP responses.

This pattern appears consistently in forums where cleaning business owners share what actually worked.

My recommendation? Start residential for the first 30-90 days. Get your systems working, build confidence, stack up some five-star reviews. Then branch into commercial if you want the bigger contracts.

Quick decision framework: 4 factors to consider

When you're deciding between residential and commercial, focus on these four factors:

How hard to start – Residential is easier. You can start tomorrow with supplies from Costco. Commercial often requires formal bids, insurance certificates, and references you don't have yet.

How fast you can start – This is critical when you want to move quickly. A residential client can hire you in 24 hours. A commercial contract takes 60-90 days minimum.

Income potential – Commercial pays more per hour, but residential has its own advantages. You can charge premium rates for specialty services like deep cleans or Airbnb turnovers.

Scalability – Both scale well, just differently. Residential scales by adding more homes per day. Commercial scales by landing bigger facility contracts.

Profitable niches to consider later

Once you've got your first 10 clients and consistent income, consider specializing in one of these profitable niches:

Airbnb turnover cleaning – Property owners need reliable cleaners between guests. It's predictable, recurring work, and you can charge 20-30% more than standard house cleaning because of the tight turnaround times.

Post-construction cleaning – New builds and renovations need deep cleans before move-in. This pays $40-60/hour but it's more intensive work. You'll deal with sawdust, paint residue, and construction debris.

Green/eco-friendly cleaning – This is premium positioning using non-toxic, environmentally safe products. It appeals to health-conscious clients willing to pay 15-20% more for peace of mind.

But for now? Keep it simple. Pick residential or commercial. Once you've made that choice, let's get you equipped.

Day 3: The bare-minimum supply kit (under $200)

Here's where most guides lose you. They recommend $2,000 in professional equipment, a dedicated van, and uniform polo shirts before you've made a single dollar.

That's backwards. Start with the minimum, get paid, then upgrade with real money.

Your $150-200 starter kit (exact list)

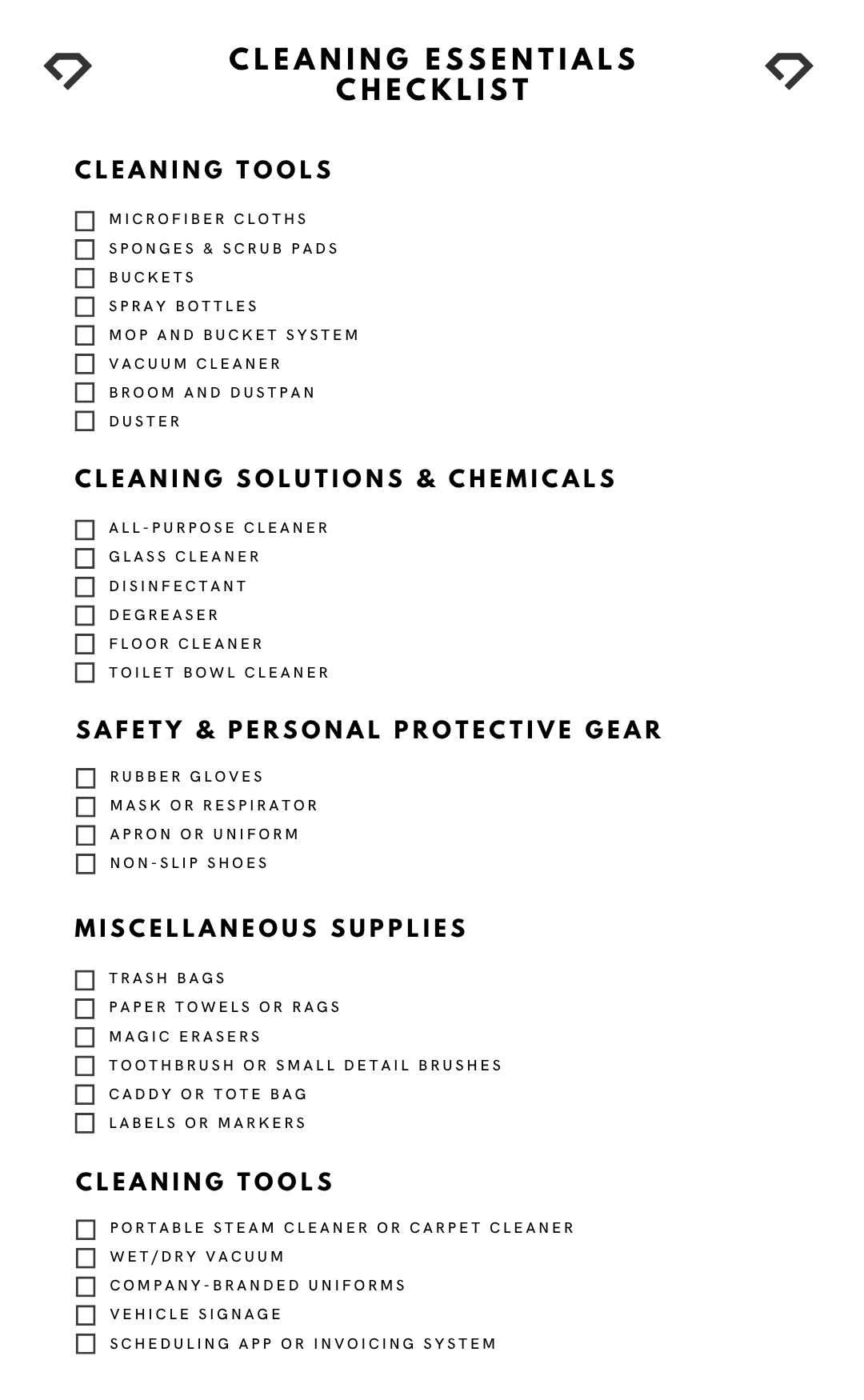

Your bare-minimum supply kit costs about $150-200 total:

- Microfiber cloths (24-pack) – $15-20 at Costco

- All-purpose cleaner (2 gallons) – $20-30

- Glass cleaner – $10

- Toilet bowl cleaner – $8

- Basic vacuum – Use what you own, or buy an $80 upright

- Mop and bucket – $25

- Rubber gloves (10 pairs) – $12

- Trash bags (heavy-duty) – $15

- Scrub brushes and sponges – $15

That's it. This is enough to clean 20-30 homes and generate $2,000-4,000 in income.

According to multiple industry analyses of startup costs, most cleaning businesses can start for under $500 when they take a lean approach. You're looking at the minimum here – and it works.

Download our cleaning essentials checklist

What to skip until you're making money

Don't buy any of this until you have paying clients:

Commercial-grade carpet cleaners ($300-800) – Your clients' vacuums work fine for regular maintenance. You only need commercial equipment if you're doing specialty deep carpet cleaning.

Pressure washers ($200+) – Not necessary for interior cleaning, which is what you're starting with.

Company vehicle wraps ($1,500-3,000) – Your personal car works fine. Nobody cares what you drive. They care if their house is clean.

Branded uniforms ($30-50 per person) – A clean t-shirt and jeans are fine for residential work. Save the branded polos for later.

Professional website ($500-2,000 if you hire a designer) – We'll cover this later, but the short version: AI tools have made this almost free now.

What other guides get wrong

Most guides tell you to invest in professional-grade equipment from day one. Here's why that's backwards: use what you have, get paid, then upgrade with real money. Nobody cares if you show up in a personal Honda Civic instead of a white van – they care if their house is spotless.

Here's what one successful founder said: "Stop fretting over cleaning supplies... Go and print 500 flyers off your own printer right NOW! Everything else is just an excuse to avoid starting."

That's the mindset you need.

Where to buy (and where NOT to)

Buy here:

- Costco or Sam's Club – Bulk supplies at wholesale prices. The membership ($60/year) pays for itself in one shopping trip.

- Home Depot or Lowe's – Good for equipment like mops, buckets, and vacuums.

- Amazon – Convenient for specialty items or when you need something delivered quickly.

Skip these:

- "Professional cleaning supplier" websites – They mark up basic supplies by 300% because they're targeting commercial operations with big budgets.

- MLM cleaning product distributors – You'll get pitched on "exclusive" products that cost 5x what you'd pay for comparable cleaners at Costco.

- Overpriced "starter kits" – Marketed specifically to new business owners at inflated prices.

Day 4: Price your first job without losing money

Pricing is where new cleaning business owners make their costliest mistakes. Charge too little, you'll work yourself to exhaustion. Quote too high, you'll scare everyone away.

Here's the simple framework successful founders use.

The 3 pricing models explained

Hourly pricing ($25-50/hour) – You charge for every hour worked. This seems fair on the surface, but it penalizes efficiency. Get faster at cleaning, and you earn less per job. Most experienced cleaners abandon this model within their first year.

Flat-rate pricing (recommended for beginners) – You quote a fixed price for the whole job: "$120 for a 2-bedroom apartment deep clean." The client knows exactly what they'll pay upfront, and you're incentivized to work efficiently. Get the job done in 2 hours instead of 3? You just gave yourself a raise. Most successful residential cleaners use flat-rate pricing based on what we've observed across hundreds of founder discussions online.

Per-square-foot pricing – Common in commercial cleaning where you might charge "$0.15 per square foot." This requires accurate measurements and is overkill for residential work. Stick with flat-rate pricing when you're starting out.

Simple formula for your first quote

Here's how to calculate a flat rate that won't lose you money:

Your rate = (Time estimate × hourly rate) + supplies + 20% buffer

Let's walk through a real example for a 2-bedroom apartment deep clean:

- Time estimate: 3 hours (when you're starting out)

- Your hourly rate: $30/hour (reasonable starting rate)

- Labor: 3 hours × $30 = $90

- Supplies: $10 (cleaning products used for this job)

- Buffer (20%): $20 (accounts for unexpected issues)

- Quote to client: $120

Here's the beautiful part: As you get faster at cleaning, that 3-hour job becomes 2 hours. You're still charging $120, but your effective hourly rate just jumped to $55/hour. That's the power of flat-rate pricing.

According to the Bureau of Labor Statistics, the median wage for cleaning professionals varies significantly by region and experience, but starting rates typically fall in the $25-35/hour range for independent operators.

The pricing mistake everyone makes

New cleaners consistently underprice by 30-40% because they're afraid of losing the client.

Here's what successful founders say about this:

"Charge way more than you think is reasonable to start. You can always come down, but you can't go up. I started at $25/hour and was exhausted and broke. Now I charge $50/hour flat rate and work half the time for double the money."

Another founder put it this way: "Don't compete on price. Compete on reliability and quality. The clients who only care about price are the worst clients – they'll nickel-and-dime you and leave bad reviews no matter how good your work is."

Here's a practical test: If you're booked solid within 2 weeks of launching, you're priced too low. Raise your rates by 10-15% immediately.

What competitors don't tell you

Jobber and NerdWallet tell you WHAT to charge (the $25-50/hour range) but not HOW to calculate it with a $200 budget and zero experience. The real answer from founders who've done it: Start at $30-35/hour (or $100-120 for a standard 2-bedroom apartment), watch what competitors charge in your area, and adjust based on demand.

Day 5-7: Get your first 3 clients (zero ad spend)

This is where the magic happens. You've chosen your niche, bought supplies, and know what to charge. Now let's get you paid.

No Google Ads. No Thumbtack. No expensive website required yet. Just three proven tactics that work in 24-72 hours.

Tactic 1: The "neighborhood launch" post

This is the fastest path to your first client. Post in your local Facebook groups and Nextdoor – places where your actual neighbors hang out.

Here's the exact template that works:

"Hi neighbors! I'm [Your Name], and I'm starting a local cleaning service right here in [Your Neighborhood]. I'm offering an introductory rate of $[Price] for the first 5 homes (normally $[Higher Price]). I'm insured, reliable, and would love to earn your trust and your business. DM me if you're interested or know someone who could use a hand!"

Why this works:

You're a real person, not a faceless corporation. The scarcity element ("first 5 homes") creates urgency without being pushy. You're offering a deal without sounding desperate. And local social proof builds trust – these are people who might live on your street.

In discussions across hundreds of founder experiences shared online, the vast majority report getting their first 3-5 clients from local Facebook groups and neighborhood forums. Only a small fraction said paid lead-generation platforms like Thumbtack were worth it in year one.

The warning nobody else gives you

Don't waste money on Thumbtack, Bark, or Angie's List in your first 90 days. The leads are sketchy and price-sensitive. You'll spend $50-150 per lead that converts at maybe 10-15%. Your neighbors will hire you for free. Start there.

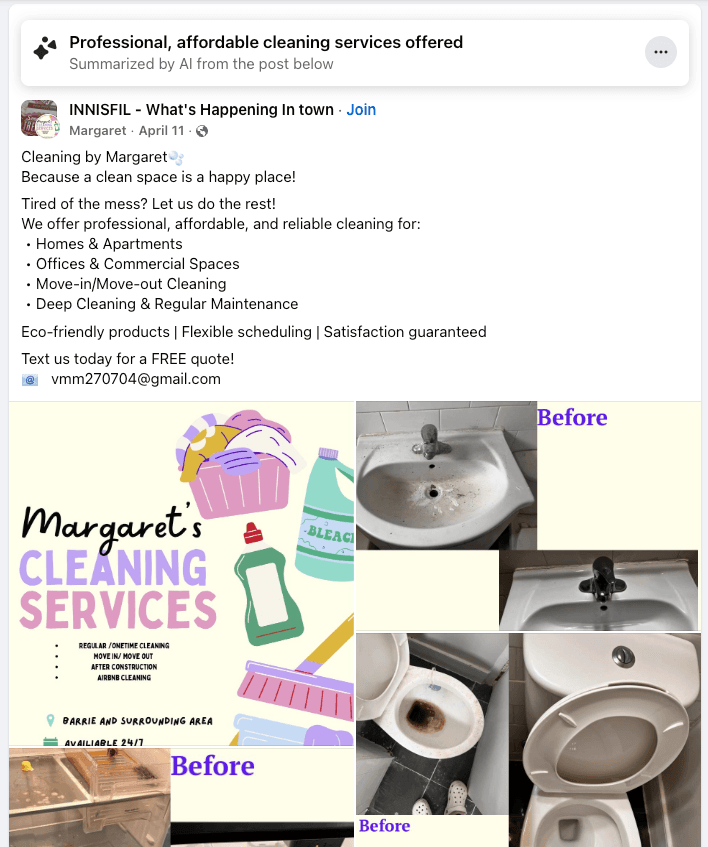

An example of a cleaning business launch post on Facebook

Tactic 2: The test run strategy

Offer 2-3 friends or family members a heavily discounted (or free) first clean in exchange for two specific things:

Honest, detailed feedback – What did you do great? What needs work? Where did you spend too much time? This feedback is gold when you're refining your process.

A video testimonial – Have them record 30 seconds on their phone: "I hired [Your Name] to clean my house and they did an amazing job. The kitchen looks incredible and they were super professional. Highly recommend!"

These testimonials become social proof for Tactic 1. Post them alongside your Facebook launch announcement. Suddenly, you're not just some person offering cleaning – you're someone with proven results and happy customers.

Tactic 3: Set up your Google Business Profile

Google Business Profile is free and shows up when people search "cleaning service near me." This is basic infrastructure.

Here's the step-by-step setup:

- Go to google.com/business

- Click "Manage now" and sign in with your Gmail

- Enter your business name and select "Cleaning service" as your category

- Add your service area (the zip codes you'll serve)

- Add your phone number and website if you have one (if not, skip it for now)

- Verify your business (Google will mail you a postcard with a verification code)

Why this matters now: 46% of all Google searches are looking for local information, and 90% of consumers use Google to find local businesses. Having a Google Business Profile puts you on the map – literally.

Once it's live, ask those first 3 test clients to leave you a 5-star review. Future clients will Google you before booking. Those early reviews often make the difference between someone calling you or moving on to the next name.

Week 2: Make it official (licenses, LLC, and legal structure)

You've done it. You have paying clients and real income. You've proven people will hire you. Now it's time to formalize the structure.

This order matters. Most guides do it backwards and leave you with an LLC, insurance, and a business bank account but zero customers. You've done it right - proven demand before investing in bureaucracy.

Let's build your foundation.

Sole proprietorship vs. LLC: What's different

These are the two structures 95% of new cleaning businesses choose. Here's the real difference:

Factor | Sole Proprietorship | LLC |

Cost | $0-50 (just local license) | $50-500 (state filing fee) |

Liability protection | None – you're personally liable | Yes – your assets are protected |

Taxes | Personal tax return (Schedule C) | Same, but more flexibility |

Complexity | Dead simple | Slightly more paperwork |

Credibility | Fine for residential | Better for commercial contracts |

The founder pattern: Most start as sole proprietorships, then upgrade to a Limited Liability Company (LLC) once they hit $50,000-75,000 in annual income or hire their first employee.

Here's why: A sole proprietorship means you and your business are the same legal entity. It's the simplest structure – you just start operating and report business income on your personal tax return. An LLC creates a separate legal entity that protects your personal assets if something goes wrong.

Many cleaning business owners choose to form an LLC to protect their personal assets from business liabilities. A sole proprietorship is another common and simpler option to start. The U.S. Small Business Administration provides detailed guidance on choosing your business structure, and it's best to consult with a legal professional to decide what's right for your situation.

Your 3-step legal checklist

Here's what you need to do to make your business legal:

1. Choose and register your business name

Search your state's business name database to make sure it's available. Most Secretary of State websites have a free search tool. If you're operating under a name different from your personal name, you'll file a "Doing Business As" (DBA) or fictitious name registration.

Cost: $10-50 depending on your state.

2. Get your local business license

Visit your city or county clerk's website and search for "business license" or "business tax receipt." Most places let you complete the application online in 10-15 minutes. You'll need to provide your business name, address, and the type of service you're offering.

Cost: $50-400 annually depending on your location. According to the SBA's licensing guide, requirements vary significantly by location.

3. Get your federal tax ID (EIN)

An Employer Identification Number (EIN) is like a Social Security number for your business. You need one if you form an LLC or hire employees. Even sole proprietors benefit from having one so you don't give out your Social Security number to clients.

You can apply for your EIN for free directly through the IRS website. It takes about 10 minutes, and you'll receive your EIN immediately.

Cost: $0 – free.

The state-by-state resource guide

Every guide says "check your local regulations" and links to nothing. That's useless. Here's actual help:

We've compiled direct links to all 50 state Secretary of State business registration pages. Whether you're in Alabama, California, New York, or Wyoming, you can click directly to your state's official registration portal.

Good news: Registration is fast now

In 2019, registering an LLC meant printing forms, writing checks, mailing everything, and waiting 6-8 weeks for approval. In 2025, most states let you register your LLC online in 24-48 hours. Some states (like Delaware and Wyoming) approve within hours.

Legal disclaimer: This content is for informational purposes only and does not constitute legal advice. Please consult with a qualified business attorney or your local Chamber of Commerce to make sure you meet all federal, state, and local requirements.

Week 2: Protect your business (insurance you can't skip)

You're now a real business with real clients entering their homes. One mistake – a broken lamp, a scratched floor, a slip and fall – can cost you thousands.

Insurance isn't optional. It's the difference between a fixable mistake and bankruptcy.

General liability: The non-negotiable

This is your first and most critical insurance coverage. General liability insurance covers property damage and bodily injury that might occur while you're working.

Real scenario: You're vacuuming a living room. The cord catches the edge of a floor lamp. It crashes down, taking a $2,000 TV with it. Without insurance, you're paying $2,000 out of pocket – probably wiping out your first month of profit. With general liability insurance, your insurance company handles the claim.

Cost: According to insurance industry data, the median premium for general liability insurance for a cleaning business is about $48 per month or $575 annually. Shop around – prices vary by state, coverage limits, and your specific business details.

What it covers:

- Property damage (broken items, scratched floors, damaged furniture)

- Bodily injury (if a client or employee gets hurt on the job)

- Legal fees if you're sued

- Medical payments for injuries

Get quotes from at least 3 providers. Next Insurance, Hiscox, and The Hartford are popular with small service businesses. The SBA's insurance guide explains what types of coverage different businesses typically need.

What does "bonded" mean?

You'll see cleaning services advertise "bonded and insured" like it's one thing. It's not.

Being bonded means you have a surety bond - basically a guarantee that if you or your employees steal from a client, the bonding company will pay the claim (and then come after you for repayment). It's protection against theft.

Being insured means you have liability insurance (which we covered above). It's protection against accidents.

When you need bonding: Most residential clients don't require it, but commercial contracts often do. It's relatively cheap ($100-300/year) and builds trust with clients who want that extra layer of protection.

You can start with just insurance for residential work. Add bonding when you go after commercial contracts or if clients start asking about it.

Workers' compensation: Only when you hire

If you're a solo operator, you don't need workers' compensation insurance. But the moment you hire your first employee (not contractor - employee), most states legally require it.

Workers' compensation covers medical expenses and lost wages if an employee gets injured on the job. Cost varies wildly by state – anywhere from $500 to $2,000 annually per employee depending on your state's laws and your payroll.

Don't skip this if you hire. It's legally required, and the fines for operating without it can be severe enough to shut down your business.

Real example: How Sarah went from zero to $8K/month in 90 days

Sarah started her residential cleaning business in March 2024 with $180 in supplies from Costco. She posted in three local Facebook groups on a Tuesday and had two clients booked by Thursday. Within 30 days, she had 12 regular clients and was grossing $3,500/month. At 90 days, she hired her first part-time cleaner and hit $8,000/month in revenue.

Her advice? "I almost waited to 'do it right' - LLC, fancy website, business cards. I'm so glad I didn't. Getting that first $120 check validated everything. The paperwork came later."

Real failure warning

Here's what one founder shared: "I skipped insurance to save $50/month. Four months in, I damaged a client's hardwood floor during a deep clean. They sued me for $8,000. I had to close my business and file for bankruptcy. Don't be me. Get insured before your first client."

Insurance disclaimer: Insurance needs vary based on your services, location, and business structure. This information is not an insurance recommendation. Speak with a licensed insurance agent to determine the right coverage for your business.

Week 3: The money system (banking, invoicing, taxes)

You're making money. Now let's make sure you keep it, track it properly, and don't get destroyed by taxes.

Separate your money (business bank account)

Mixing business and personal finances is the number one mistake that kills new businesses during tax season.

Why you need a separate business bank account:

Legal protection – If you're an LLC, keeping funds separate maintains your liability shield. Mixing funds is called "piercing the corporate veil" and can destroy your LLC protection in a lawsuit.

Clean bookkeeping – You can see exactly what your business is earning and spending without digging through personal transactions.

Tax preparation – Your CPA (or you) won't have to untangle Starbucks purchases from supply runs when tax time comes.

How to open one:

Most banks make this straightforward. Choose a bank (Chase, Bank of America, and local credit unions typically offer free business checking for new businesses). Bring your EIN letter and LLC formation documents if you have them, or just your driver's license if you're a sole proprietor. Make an initial deposit (usually $25-100 minimum).

The SBA's guide to opening a business bank account walks through what documents you'll need.

Cost: Many banks offer free business checking for the first 1-2 years, or if you maintain a minimum balance (usually $1,500-2,500).

Get paid professionally

Early on, Venmo and Zelle are fine for collecting payment from friends and small residential clients. But as you grow, you need a real invoicing system.

What to include on every invoice:

- Your business name, address, and phone number

- Client's name and service address

- Invoice number and date

- Service description and date performed

- Amount due and payment terms ("Due upon receipt" or "Net 30")

- Payment methods accepted

Payment processors to consider:

- Square – 2.6% + $0.10 per transaction

- Stripe – 2.9% + $0.30 per transaction

- PayPal – 2.99% + $0.49 per transaction

Many clients prefer to pay by credit card. Accepting cards removes a barrier that causes some clients to choose competitors who offer that convenience. Yes, you pay processing fees, but the convenience often means faster payment and fewer excuses.

Taxes for the self-employed

This is where sole proprietors get surprised. You're not an employee anymore – you're self-employed. That changes everything about taxes.

Self-employment tax: According to the IRS, you'll owe about 15.3% on your net income. This covers Social Security and Medicare taxes that would normally be split between you and an employer. You pay both halves now.

The rule of thumb: Set aside 25-30% of every dollar you earn for taxes. Put it in a separate savings account and don't touch it.

Quarterly estimated payments: If you're making over $1,000/year in profit, the IRS requires you to make quarterly estimated tax payments (due April 15, June 15, September 15, and January 15). Miss these, and you'll pay penalties.

Deductions you can take:

- Supplies and equipment

- Vehicle mileage (check IRS.gov for current year's standard rate)

- Insurance premiums

- Phone and internet (business portion)

- Home office (if you have a dedicated space used only for business)

Keep receipts for everything. A simple Excel spreadsheet or free tool like Wave can track your income and expenses.

Tax disclaimer: Tax laws are complex and change frequently. The information provided here is for general guidance. It's important to consult with a certified public accountant (CPA) or tax professional for advice tailored to your situation.

Startup cost breakdown

Expense Category | Lean Startup | Full Scale |

One-time costs | ||

LLC registration | $0 (sole prop) | $50-500 |

Equipment & supplies | $150-200 | $500-800 |

Website | $0 (DIY with AI) | $500-2,000 |

Monthly costs | ||

Insurance | $48 | $75-150 |

Software/tools | $10-30 | $60-100 |

Supplies (ongoing) | $50-100 | $150-300 |

Marketing | $0-50 | $200-500 |

Total first month | $248-428 | $1,485-4,350 |

You can start a profitable cleaning business for under $500. Or you can go full scale with commercial equipment, LLC, fancy branding, and multiple software subscriptions for $5,000-10,000. Most founders start lean, prove the model, then upgrade with real money.

Week 4: Build your online presence (website + reviews)

You've got clients. You've got income. Now you need an online presence that makes you look as professional as you are.

Why you need a website (even if clients find you on Facebook)

Here's what happens when a potential client sees your Facebook post:

They're interested. They Google your business name. They expect to find a website. If they don't, many move on to someone who looks more established.

A website isn't about getting found (that's what Google Business Profile is for). A website is about legitimacy and trust. It's the difference between looking like a side hustle and looking like a real business.

Why building a website is easier now than ever

In 2019, you'd need to cobble together multiple tools and pay separately for each:

- Web designer: $1,500-3,000 upfront, then 2-3 weeks for first draft, another 2 weeks of revisions

- Website hosting: $15-30/month

- Accounting software: $25/month (QuickBooks)

- CRM to track clients: $15-50/month (HubSpot, Salesforce)

- Invoice software: $10/month (FreshBooks)

Total: $1,500-3,000 upfront + $65-115/month, juggling 4+ different logins, and 4-6 weeks of waiting.

In 2025, AI-powered platforms changed everything:

- Website generation: AI analyzes your business type and generates a complete, professional website in 30 seconds – with service descriptions, contact forms, and professional images

- All-in-one tools: Website + CRM + invoicing + customer management in one platform for $10-30/month total

- No technical skills needed: Edit anything yourself without knowing code

- Instant launch: Go from idea to live website in under 5 minutes

You no longer need to hire a web designer, learn to code, or wait weeks for revisions. Tools like Durable's AI Website Builder analyze your business type and generate a professional, fully-functional website in about 30 seconds. Whether you use Durable, Wix, or Squarespace, the key is: don't let "I need a perfect website" delay your launch.

The barrier that used to stop 80% of new businesses? Gone.

Get your first 5 reviews fast

Reviews are currency in the service business. Five 5-star reviews often make the difference between someone calling you or scrolling past.

How to get them:

1. Ask immediately after the job - Don't wait. Right when you finish and the client's happy, say: "I'm building my business and reviews really help. If you were happy with my work, would you mind leaving a quick review on Google?"

2. Make it easy - Text them a direct link to your Google Business Profile review page. Don't make them search for you. The easier you make it, the more likely they'll do it.

3. Offer a small incentive (carefully) - Google's policies prohibit paying for reviews, but you can offer a "thank you gift" for customers who leave honest feedback. Something like "$10 off your next clean as a thank you for your time."

4. Use your test clients - Remember those friends and family you cleaned for in Week 1? Now's the time to ask them to post those reviews on Google.

The goal: 5 reviews within your first 30 days. After that, you'll naturally accumulate more as you serve more clients. But those first 5 make the critical difference.

Month 3: Hire your first team member (when and how)

Here's the truth about scaling a cleaning business: Your income is capped by how much you can personally do until you hire.

You can clean 2-3 homes per day maximum. At $120 per home, that's $240-360/day or about $5,000-7,500/month working 5 days per week. To break six figures, you need help.

But hiring is also the hardest part of this business. Not finding clients. Not pricing. Hiring.

5 signs you're ready to hire

Don't hire too early (you'll lose money) or too late (you'll burn out). Hire when you see these signs:

1. You're turning down work consistently – You're booked solid and referring potential clients to competitors because you can't take more work.

2. You're booked 4+ weeks out – New clients can't get in for a month. This is lost income and frustrated customers.

3. Income exceeds $8,000/month consistently – You can afford to pay someone $15-20/hour and still make good profit.

4. You have systems documented – You can train someone because you've written down your cleaning process, supply lists, and quality standards.

5. You have at least 3 months of runway – You can cover payroll even if a few clients cancel or income dips temporarily.

If you check 4 out of 5 boxes, it's time.

Contractor vs. employee (the legal reality)

This is where new business owners make expensive mistakes. The IRS has clear rules about who qualifies as an independent contractor vs. an employee.

Independent contractor:

- Sets their own schedule

- Uses their own equipment

- Works for multiple clients

- You pay them per job with no taxes withheld

Employee:

- You set their schedule

- You provide equipment and supplies

- They work primarily or only for you

- You withhold taxes and pay payroll taxes

The truth: Most cleaning businesses hire W-2 employees, not contractors. The IRS scrutinizes worker misclassification heavily in this industry. Penalties can be severe – back taxes, fines, and legal fees.

Consult a payroll service like Gusto or ADP. They'll help you get worker classification right from day one and handle all the tax withholding automatically.

Where to find reliable cleaners

Job boards that work:

- Indeed – Free job posts, large candidate pool

- Local Facebook job groups – Strong for finding local workers

- Craigslist – Surprisingly effective for hourly service work

- Word-of-mouth referrals – Ask your network if they know anyone looking for work

What to look for:

- Reliable transportation

- At least 2 years of work or personal references

- Legal authorization to work in the U.S.

- Comfortable with physical work (cleaning is demanding)

- Detail-oriented personality (you can test this in the interview)

The interview test: Here's a tactic that works. Have candidates clean a small bathroom in your home while you observe. Pay them $25 for their time regardless of whether you hire them. You'll learn more in 20 minutes of watching them work than in 5 rounds of traditional interviews.

Real warning from experienced founders

"Hiring is the hardest part of scaling. Not finding clients, not pricing - finding people who show up consistently and care about quality. Budget 3-6 months to find your first solid hire. Expect to go through 5-10 candidates before you find a keeper. That's normal, not a reflection on you."

What competitors sugarcoat

Most guides make hiring sound easy: "Post a job, conduct interviews, hire the best candidate!" That's nonsense. The reality's messier. Expect bad hires, no-shows, and people who quit after two days. The difference between success and failure isn't avoiding bad hires – it's having a system so you can quickly replace them when they don't work out.

The SBA's guide to hiring and managing employees covers the legal requirements and paperwork involved.

Set up systems: CRM, scheduling, and invoicing software

Right now, you're probably tracking everything in your head or maybe a Notes app. That works for 5-10 clients. It breaks down at 20-30.

You need systems that run without you constantly thinking about them.

The 3 software categories you need

1. Client management (CRM) – Track who your clients are, when you last cleaned for them, their specific preferences (Mrs. Johnson hates lavender scent), and payment history. Without this, you'll start forgetting important details and clients will notice.

2. Scheduling – Stop playing phone tag to book appointments. Let clients book available time slots online, send automatic appointment reminders, and manage your calendar without the back-and-forth texting.

3. Invoicing – Send professional invoices automatically after each job, track who's paid and who hasn't, and accept card payments without manual entry every time.

All-in-one vs. best-of-breed

You have two paths:

Best-of-breed: Use specialized tools for each function. Calendly for scheduling ($15/mo), HubSpot CRM (free but complicated), QuickBooks for invoicing ($25/mo). You get more powerful features for each specific function, but you're managing 3+ separate tools and logins.

All-in-one: Use a platform that does everything in one place. Less powerful for any single function, but dramatically simpler. For most cleaning businesses under $100K income, this is the better choice.

Platforms like Durable bundle website + CRM + invoicing for less than you'd pay for QuickBooks alone. Some founders prefer specialized tools like Jobber (built specifically for field service businesses). Others want the simplicity of everything in one login.

The right answer depends on your complexity and preferences. Starting out? Go all-in-one. You can always upgrade to specialized tools as you scale and your needs become more specific.

Frequently asked questions

Is starting a cleaning business worth it? (Costs, timeline, income potential)

Yes, starting a cleaning business can be very worth it. According to Fortune Business Insights, the industry's growing at 7.19% annually, startup costs are low ($200-2,000 to start), and demand is strong for both residential and commercial services. Many owners build six-figure businesses within 2-3 years. The key advantages: flexible schedule, low barriers to entry, recurring income from repeat clients, and the ability to start while keeping your day job.

Can you start a cleaning business by yourself?

Yes. According to industry statistics, 90% of cleaning businesses have fewer than 10 employees, and most start as solo operations. Working by yourself initially is the best way to keep costs low, learn the business firsthand, and build a strong reputation. You can handle all the cleaning and admin tasks yourself before deciding to hire employees as your client base grows. Many successful owners stay solo for 6-12 months before hiring their first team member.

What's the most profitable type of cleaning business?

Commercial cleaning typically makes more profit (35-40%) compared to residential (25-35%), but residential cleaning is faster to start and easier to scale initially. The most profitable niches within cleaning include: post-construction cleaning ($40-60/hour), Airbnb turnover service (high volume, recurring income), medical facility cleaning (premium rates, specialized requirements), and green/eco-friendly cleaning (15-20% premium pricing). Start with general residential to build skills and reputation, then specialize based on what you enjoy and what's in demand locally.

Do I need a license to start a cleaning business?

Most cities and counties require a general business license to operate legally, which typically costs $50-400 annually. However, cleaning businesses usually don't need specialized occupational licenses like plumbers or electricians do. Requirements vary significantly by location – some states require nothing beyond a business license, while others may require registration with the state. Check with your local city clerk's office and your state's Secretary of State website for specific requirements in your area.

How do I get clients for my cleaning business? (4 free tactics that work)

The fastest ways to get your first clients are: (1) Post in local Facebook groups and Nextdoor offering introductory rates, (2) Set up a free Google Business Profile so you appear in local searches, (3) Ask friends and family for referrals and testimonials, (4) Distribute door hangers or flyers in target neighborhoods. Avoid paid lead generation sites like Thumbtack in your first year – the leads are expensive ($50-150 each) and price-sensitive. Focus on local, organic methods that build word-of-mouth referrals and don't eat into your thin early profit.

How much money do I need to start a cleaning business?

You can start a lean cleaning business for $200-500 covering basic supplies, initial insurance payment, and business registration. According to startup cost analysis, a more complete setup (LLC, professional website, commercial equipment, initial marketing) costs $2,000-5,000. The minimum viable startup requires: $150-200 in cleaning supplies, $48-75 for first month's insurance, and $50-400 for a business license. You can start as a sole proprietor using personal equipment and upgrade later with real money.

Should I form an LLC right away?

You don't need to form an LLC immediately. Many successful cleaning business owners start as sole proprietors to test the business model, then upgrade to an LLC once they're earning $50,000+ annually or hire their first employee. LLCs provide liability protection (separating personal and business assets) and can offer tax benefits, but they cost $50-500 to establish and require more paperwork. Start lean, then formalize your structure once you have real income.

What insurance do I need?

General liability insurance is non-negotiable. It covers property damage and bodily injury if something goes wrong at a client's home or business. According to insurance cost data, this typically costs $48-75/month. Once you hire employees, workers' compensation insurance becomes legally required in most states. A janitorial bond (protects clients from theft) is often required for commercial contracts but optional for residential work. Get insured before your very first client – one accident without coverage can bankrupt your business.

How do I price my first cleaning job?

Use flat-rate pricing instead of hourly. Calculate: (estimated hours × $30-35/hour) + supplies + 20% buffer. For example, a 2-bedroom apartment deep clean typically takes 3 hours, so quote $120-150. As you get faster at cleaning, your effective hourly rate increases while your price stays competitive with the market. Research local competitors' pricing and start in the middle of the range. If you're booked solid within 2 weeks of launching, you're priced too low – raise your rates by 10-15% immediately.

When should I hire my first employee?

Hire your first employee when you see these 5 signs: (1) You're consistently turning down work because you can't take more, (2) You're booked 4+ weeks out, (3) Monthly income exceeds $8,000 consistently, (4) You have documented systems someone else can follow, and (5) You have 3 months of financial runway to cover payroll even if income dips. Most successful cleaning business owners hire their first team member between months 6-12 of operation. Don't hire too early (you'll lose money) or too late (you'll burn out).

You're ready to start your cleaning business

You now have everything you need to launch a profitable cleaning business in the next 7 days. Not 6 months from now. Not after you've perfected a 30-page business plan or saved up $10,000. This week.

Forget the intimidating 12-step checklists that leave you paralyzed. The path's simpler than the old guides make it seem: Set up your online presence today. Post in your local Facebook group this afternoon. Quote your first job tomorrow. Clean those first 3 homes this week. Handle the legal stuff once you have paying clients. That's how 200+ successful founders did it.

The biggest change since 2019 isn't the cleaning industry - it's the tools available to you. What used to require a web designer, a developer, a bookkeeper, and months of setup can now happen in minutes with AI-powered platforms. The barrier that stopped 80% of aspiring entrepreneurs has been removed.

You don't need everything perfect. You need your first dollar. You need proof that someone will pay you to clean their space. Everything else builds from there.

Here's your action plan:

When potential clients see your Facebook post today, they'll Google your business name. If they find a professional website with your services and pricing, you look legitimate. If they find nothing, many move on. That's why step one is getting online fast.

- Right now: Launch your business with Durable at durable.co – get your website, logo, and business tools set up in 3 minutes

- This afternoon: Post in 3 local Facebook groups offering intro rates for the first 5 neighbors

- Tomorrow: Buy $200 in supplies from Costco and get insurance ($48 for first month)

- This week: Clean your first 3 homes and collect video testimonials

- Next week: Set up your LLC (or stay sole proprietor) and open a business bank account

- Month 2: Use AI Chat to refine your pricing and growth strategy based on real customer data

- Month 3: Hire your first team member when you're consistently turning down work

Why Durable? It builds your complete cleaning business in 3 minutes – professional website, business logo, service descriptions, customer management, and invoicing tools. Then AI Chat learns your business and helps you make decisions – from pricing your first job to planning your growth strategy. It's like having a business partner who handles all the "business stuff" while you focus on cleaning and serving customers.

Everything in one place, for less than the cost of a single traditional tool.

You've got this. Now go make it happen.

Start your cleaning business with Durable